Subscribe to

Posts [Atom]

Friday, March 06, 2009

Disappointment Over Larry Kissell

The U.S. House voted yesterday 239-191 to pass H.R.1106, Helping Families Save Their Homes Act of 2009, written "To prevent mortgage foreclosures and enhance mortgage credit availability."

The U.S. House voted yesterday 239-191 to pass H.R.1106, Helping Families Save Their Homes Act of 2009, written "To prevent mortgage foreclosures and enhance mortgage credit availability."Some 24 Democrats voted against the bill. Based on his developing track record, we fully expected that one of those 24 Democrats would have been Heath Shuler, The Blue Meanie. But, no. Shuler voted for it. So did Republican Walter Jones.

Voting against it were all the rest of the N.C. Republican delegation and ... Democrat Larry Kissell, newly elected last fall.

We've been searching for much of the day for any on-the-record explanation from Kissell of why he voted against the bill. Haven't seen anything. We have seen, however, angry reactions from some of the folks over at BlueNC. Kissell often posted at BlueNC while he was running against Robin Hayes, and at least one poster is calling for him to come on back and 'splain his vote.

He needs to do that.

Labels: BlueNC, Heath Shuler, Larry Kissell, mortgage crisis

Thursday, March 05, 2009

Jon Stewart Strafes CNBC

Man, oh man. Did you see Jon Stewart last night on The Daily Show rip into those nimrods over at CNBC? Starting with Rick Santelli, but hardly stopping there. In fact, Stewart's whole show might be dubbed "Wall Street (and Those Who Enable It) Are Dicks," and it's worth watching all three segments, including his interview with Joe Nocera, business columnist for the NYTimes. The videos are all here, labeled "CNBC Gives Financial Advice," "The DOW Knows All," and "Joe Nocera."

Best line: "If I'd only followed CNBC's advice, I'd have a million dollars today, provided I started with a hundred million dollars."

Best line: "If I'd only followed CNBC's advice, I'd have a million dollars today, provided I started with a hundred million dollars."

Labels: CNBC, financial crisis, Jon Stewart, mortgage crisis

Sunday, March 01, 2009

The Callousness of Virginia Foxx

If you want to see Virginia Foxx's true feelings about the people in her Fifth District who are losing their homes to foreclosure, you can go here and watch what she said Thursday in floor debate over H.R. 1106, "Helping Families Save Their Homes Act."

If you want to see Virginia Foxx's true feelings about the people in her Fifth District who are losing their homes to foreclosure, you can go here and watch what she said Thursday in floor debate over H.R. 1106, "Helping Families Save Their Homes Act."Citing no evidence for her sweeping condemnation of the deadbeats in foreclosure, Madam Foxx said that "most of these people never expected to pay the loans back." She came very close to calling them "welfare queens" and did say they are infected with "the welfare mentality."

Great tack, this! Rick Santelli got famous overnight by calling the people getting kicked out of their homes "losers," a word that was so clearly on the tip of Madam Foxx's thick tongue.

Meanwhile, we applaud these conservative clowns for sticking to these particular guns, while recent polling shows that 61 percent of Americans approve of Obama's mortgage refinancing plan, about the same number that were approving of President Obama generally, even before he gave his speech to the joint session of Congress (after which his approval rating jumped to 80 percent).

Public's approval of Madam Foxx? Not so much.

Labels: Barack Obama, mortgage crisis, Virginia Foxx

Monday, July 14, 2008

Weather Continues Fine, With Good Visibility

Apparently, if you've got enough political mojo, you can find an economist to predict whatever you want predicted, which perhaps accounts for all that continuing willful belief out there that the economy is actually just hunky-dory, and if we say or (heaven forbid!) THINK differently, we're WHINERS or off our friggin rockers, so we're not supposing here that the economic analysts cited below are any more infallible than the Bush Team of Certified Geniuses, but still. Some smart people think we're in deep doo-doo and that Republican economic policies are largely to blame, starting with their deregulation of the mortgage industry.

Apparently, if you've got enough political mojo, you can find an economist to predict whatever you want predicted, which perhaps accounts for all that continuing willful belief out there that the economy is actually just hunky-dory, and if we say or (heaven forbid!) THINK differently, we're WHINERS or off our friggin rockers, so we're not supposing here that the economic analysts cited below are any more infallible than the Bush Team of Certified Geniuses, but still. Some smart people think we're in deep doo-doo and that Republican economic policies are largely to blame, starting with their deregulation of the mortgage industry.John Mauldin, for example. He seems to have predicted the housing bubble back in 2005, and now he's predicting the largest credit contraction in DECADES (he uses all caps too), based on projections that there are another $1.6 TRILLION in bank losses (world-wide) yet to come, "four times official estimates and enough to pose a grave risk to the financial system."

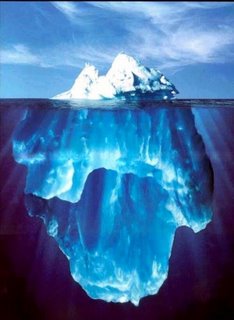

In other words, IndyMac in California and Fannie Mae and Freddie Mac are the tip of a very large iceberg.

Large and unpredictable enough to cause Treasury Secretary Paulson to say last Thursday that "no bank is too big to fail. That is for public consumption." Large and unpredictable enough even to cause John McCain to change his tune, abandoning Republican boilerplate gospel (no government intervention), which he was still spouting in May, to his blind staggers of last Thursday following Secretary Paulson's dire warning: "Give us government bailouts. Please!"

"And, by the way, please put me and my slavish adherence to Bushonomics in charge of your economic futures. I promise to be as sunnily clueness as our last schmo."

Labels: bank failures, Bush economy, John McCain, mortgage crisis